In the ever-evolving landscape of global e-commerce and international business transactions, the role of cross-border payment gateways has become absolutely crucial. As businesses expand their reach across borders, understanding the fees associated with these gateways is not just important – it's essential for maintaining profitability and making informed decisions. That's precisely why we've put together this comprehensive comparison of fees in cross-border payment gateways for the 2023 edition.

The Significance of Cross-Border Payment Gateways

Cross-border payment gateways act as the bridges that enable seamless financial transactions between businesses and customers located in different countries. They handle everything from currency conversion to ensuring the security and integrity of the payment process. Without reliable payment gateways, the growth of international trade would be severely hampered.

However, with numerous options available in the market, each with its own fee structure, it can be a daunting task for businesses to choose the right one. This is where our detailed comparison comes into play, helping you cut through the confusion and make a choice that aligns with your business needs and budget.

Factors Affecting Cross-Border Payment Gateway Fees

Before delving into the specific fee comparisons, it's important to understand the various factors that influence the fees charged by these gateways. Here are some of the key elements:

Transaction Volume

Most payment gateways offer tiered pricing based on the volume of transactions a business conducts. Generally, the higher the transaction volume, the lower the per-transaction fee. This is because larger volumes indicate a more significant and potentially long-term relationship with the gateway provider, and they are willing to offer incentives to retain such customers.

For example, a small business just starting with cross-border sales and processing only a few transactions per month might be charged a relatively high per-transaction fee compared to a large multinational corporation that processes thousands of transactions daily. It's crucial for businesses to estimate their expected transaction volume accurately to get a clear picture of the potential costs involved.

Currency Conversion

When dealing with cross-border payments, currency conversion is inevitable. Payment gateways typically charge a fee for this service, which can vary significantly from one provider to another. Some gateways may offer more competitive exchange rates but levy a higher conversion fee, while others might have a less favorable rate but a lower fee.

Let's say you're a US-based business selling to customers in Europe. If the payment gateway you choose has a high currency conversion fee, it could eat into your profit margins significantly. It's advisable to look closely at the currency conversion details and compare different providers to find the most cost-effective option.

Payment Methods Accepted

Different payment gateways support various payment methods, such as credit cards, debit cards, digital wallets, and bank transfers. The more payment methods a gateway offers, the more complex its fee structure might be. Some payment methods may incur higher fees due to their associated risks or processing requirements.

For instance, accepting payments via certain digital wallets might come with a higher fee compared to traditional credit card payments. This is because digital wallets often involve additional security and integration steps. Businesses need to consider which payment methods are most popular among their target customers and weigh the associated fees accordingly.

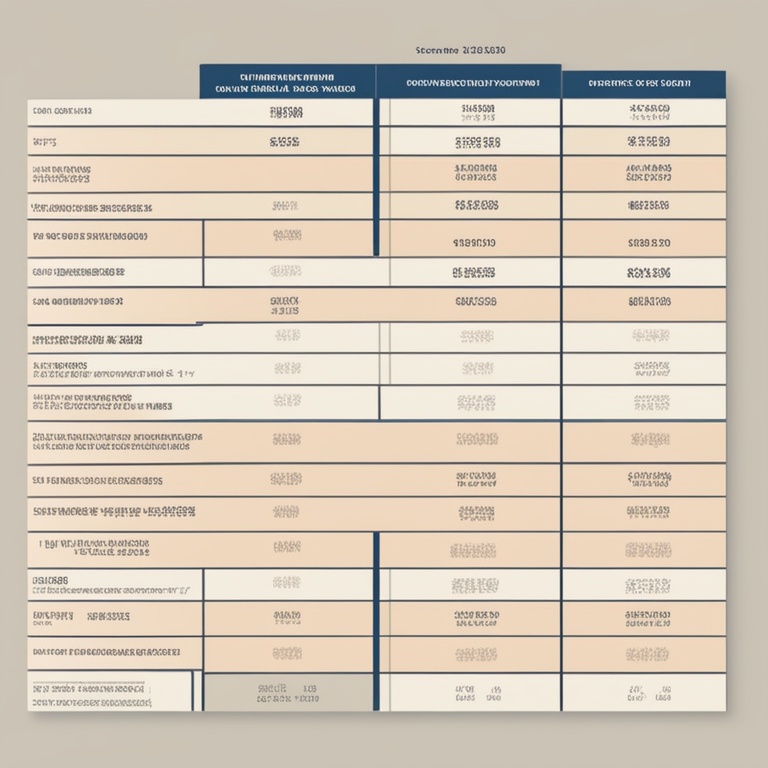

Detailed Comparison of Popular Cross-Border Payment Gateways (2023)

Now, let's take a closer look at some of the leading cross-border payment gateways and compare their fee structures as of 2023.

PayPal

PayPal is a household name in the world of online payments and is widely used for cross-border transactions. Its fee structure is relatively straightforward but varies depending on several factors.

For international sales, PayPal typically charges a percentage of the transaction amount plus a fixed fee. The percentage can range from around 3% to 5% depending on the country of the buyer and the volume of transactions. The fixed fee usually ranges from $0.30 to $0.50 per transaction.

When it comes to currency conversion, PayPal's rates are not always the most competitive. They do offer a convenient option for businesses that already have a significant presence on their platform and want a quick and easy payment solution. However, if currency conversion costs are a major concern, it might be worth exploring other gateways.

Stripe

Stripe has gained a reputation for its developer-friendly interface and robust payment processing capabilities. Its fee structure for cross-border payments is also tiered based on transaction volume.

For businesses with lower transaction volumes, Stripe might charge around 2.9% plus $0.30 per transaction. As the volume increases, the percentage fee can decrease to as low as 1.4% plus a lower fixed fee. Stripe also offers competitive currency conversion rates, which can be a significant advantage for businesses dealing with multiple currencies.

However, Stripe's setup and integration process can be a bit more technical compared to some other gateways. But if you have the technical expertise or can afford to hire someone to handle the integration, it could be a great option in terms of cost and functionality.

Adyen

Adyen is known for its global reach and ability to handle complex payment scenarios. Its fee structure is a bit more customized and depends on various factors such as the industry of the business, the payment methods used, and the geographical regions involved.

On average, Adyen's fees can range from 1% to 3% of the transaction amount plus a variable fixed fee. The currency conversion rates offered by Adyen are often quite competitive, and they have a strong focus on providing seamless payment experiences across different regions.

One drawback of Adyen is that it may require a more in-depth onboarding process and a higher level of compliance checks compared to some other gateways. But for businesses that operate in highly regulated industries or have specific payment requirements, Adyen could be a top choice.

Making the Right Choice for Your Business

Now that we've explored the fee structures of some of the leading cross-border payment gateways, how do you decide which one is the best fit for your business? Here are some key considerations:

Transaction Volume Projections

As mentioned earlier, your expected transaction volume plays a crucial role in determining the most cost-effective payment gateway. If you're a startup with low initial volume but anticipate rapid growth, you might want to choose a gateway that offers favorable terms for increasing volumes over time, such as Stripe.

On the other hand, if you're an established business with a stable and high volume of transactions, you could potentially negotiate better rates with gateways like Adyen that offer more customized fee structures based on your specific situation.

Currency Conversion Needs

If your business deals with a significant amount of cross-border transactions involving different currencies, the currency conversion fees and rates of the payment gateway become extremely important.

For example, if you're regularly selling to customers in multiple countries and need to convert currencies frequently, a gateway like Stripe with competitive currency conversion rates might be a better choice than PayPal, which may have higher conversion costs.

Payment Method Preferences

Consider which payment methods are most popular among your target customers. If your customers predominantly use digital wallets, you'll need to ensure that the payment gateway you choose supports those wallets and doesn't charge exorbitant fees for their use.

Similarly, if credit card payments are the norm for your customers, you'll want to look at the credit card processing fees of different gateways. For instance, PayPal's credit card processing fees might be different from those of Stripe, and you need to compare them based on your actual situation.

Technical Requirements and Integration

Some payment gateways, like Stripe, require a certain level of technical expertise for setup and integration. If you have an in-house IT team or can afford to hire external developers, this might not be an issue.

However, if you're a small business with limited technical resources, you might prefer a gateway like PayPal that offers a more straightforward and user-friendly integration process. But keep in mind that the ease of integration might come at the cost of potentially higher fees in some cases.

The Bottom Line

Choosing the right cross-border payment gateway is not a one-size-fits-all decision. It requires careful consideration of various factors, including the fee structure, currency conversion, payment methods, and technical requirements. By taking the time to analyze and compare the different options available in 2023, you can make an informed decision that will not only save your business money in the long run but also ensure a seamless and efficient payment process for your customers.

Don't simply settle for the first payment gateway that comes your way. Instead, use this comprehensive comparison as a guide to find the gateway that best meets your specific business needs and helps you thrive in the competitive world of cross-border e-commerce.